Bond total return calculator

That was in 2014. Current Price Par Value.

Step 1 Capital Structure Of A Company Cost Of Capital Calculator Step Guide

The formula for total cost can be derived by using the following five steps.

. A bond yield is the amount of return an investor realizes on a bond. Clicking the Calculate button will return the GAR. The relationships among maturity length yield rise and total return can be seen in the events from April 30 through September 30 2013.

Tiingo isnt free so we have some. The data table in this muni bond calculator allows the user to edit numbers directly in the table. Sovereign Gold Bonds 2022-23-Series-I.

Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. For each bond the current yield is equal to the annual coupon divided by the bonds face value FV.

If a bond is trading at par the current yield is equal to the stated coupon rate thus the current yield on the par bond is 6. Much of the features are the same but especially for smaller funds the dividend data might be off. Input each years return rate.

Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. Source and Methodology of the Exchange Traded Fund Total Return Calculator. Your current return you would expect is 435.

Firstly determine the cost of production which is fixed in nature ie. This shows the difference between the two rates of return. The number of periods is six.

They rocketed from 167 to 262 showing a quick drop in prices. You would need to discount the price of your bond to the point where the buyer would achieve the same total return being offered by the bond paying 8. In the case of.

Several types of bond yields exist including nominal yield which is the interest paid divided by the face value of. The tool uses the Tiingo API for price and dividend data. If youd like to know how to estimate compound interest see the article.

Total Cost 20000 6 3000. NSE Code Gold Bond Name Issue Date Redemption Year Retail Price LTP Interest Income Total PL PL Percent. Also at the end of three years the bondholder receives the face value of 1000.

That was in 2014. Years into the tool and even more into some of our others we continue to stress that you need to produce fair dividend reinvested return comparisons when discussing investments. Some examples of the fixed cost of production are selling expense rent expense.

Relevance and Uses of Expected Return Formula As mentioned above the Expected Return calculation is based on historical data and hence it has a limitation of forecasting future possible returns. This handy geometric average return GAR calculator can be used with investments that undergo compounding over a number of timespans to calculate the average rate per period. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button.

To arrive at this figure the stock calculator divides the total return on investment by the total original investment and then multiplies that result by 1N where N is the number of years the investment is held. Calculator Guide A Beginners Guide to Investing in Bonds. Sovereign Gold Bond Return Calculator.

And the bondholder receives these payments for three years which means there is a total of six coupon payments ie. Discount Bond 60 950 632. Total Cost 38000 Explanation.

See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. That cost which do not change with the change in the level of production. You must consider the total amount of money you want to invest The goal here is to create a ladder with the necessary number of rungs bonds to generate a.

And in most cases they can expect to get their initial investment back on or before the date the bond matures. Treasury note which was used as a benchmark. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate.

Sovereign Gold Bonds 2022-23-Series-II. Total Coupon Cash Flow - The sum of the coupon cash flow until maturity. As we all know the risk free return would be the 10 year Treasury bond yield of United States Government.

This calculator enables you to compare the reaction of two bonds to changes in the prevailing rate of return in the bond market. Long-term bond yields soared along with the 10-year US. This pertains to the Coupon and the Straight Line Amortized Value columns in the table.

Input the number of years. The ETF return calculator is a derivative of the stock return calculator. We originally built a version of this stock total return calculator for DQYDJs five year anniversary and 749th published article.

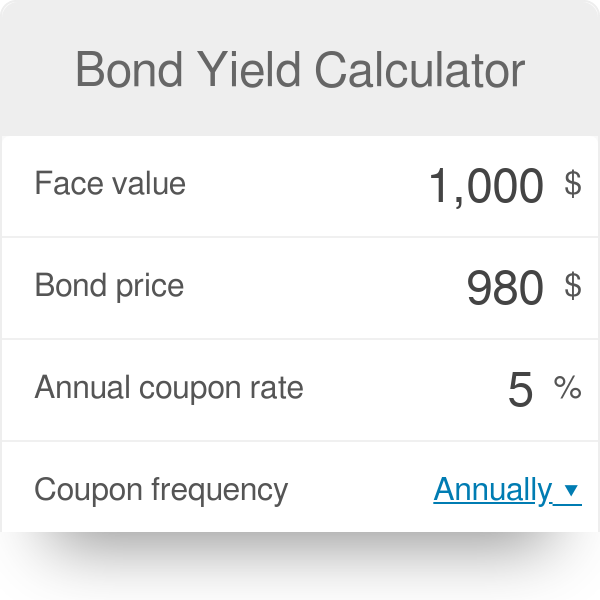

Bond Yield Calculator

Frm Ti Ba Ii To Compute Bond Yield Ytm Youtube

Bond Yield Calculator Calculate Bond Returns

Bond Yield Calculator

Rate Of Return Formula Calculator Excel Template

Coupon Rate Formula Calculator Excel Template

1031 Exchange How Do Sales Costs Of Dst S Compare With Traditi Investing Corporate Bonds Selling Real Estate

Bond Yield Formula Calculator Example With Excel Template

Bond Yield Calculator

Excel Sum And Offset Formula Tutorial Excel Excel Macros Microsoft Excel

Bond Pricing Formula How To Calculate Bond Price Examples

Yield To Maturity Ytm Formula And Calculator Excel Template

Long Term Debt Ratio Calculator Debt Ratio Debt Financial Management

Bond Equivalent Yield Formula Calculator Excel Template

How To Calculate Sum Of Squares Sum Of Squares Sum Standard Deviation

How To Calculate The Rate Of Return On A Coupon Bond Youtube

Yield To Call Ytc Bond Formula And Calculator Excel Template